Humana Medicare Supplement Insurance Plans take the spotlight as we delve into the realm of healthcare coverage, offering a detailed look at the benefits and choices available.

With a focus on providing clarity and understanding, this exploration aims to guide individuals towards making informed decisions for their healthcare needs.

Overview of Humana Medicare Supplement Insurance Plans

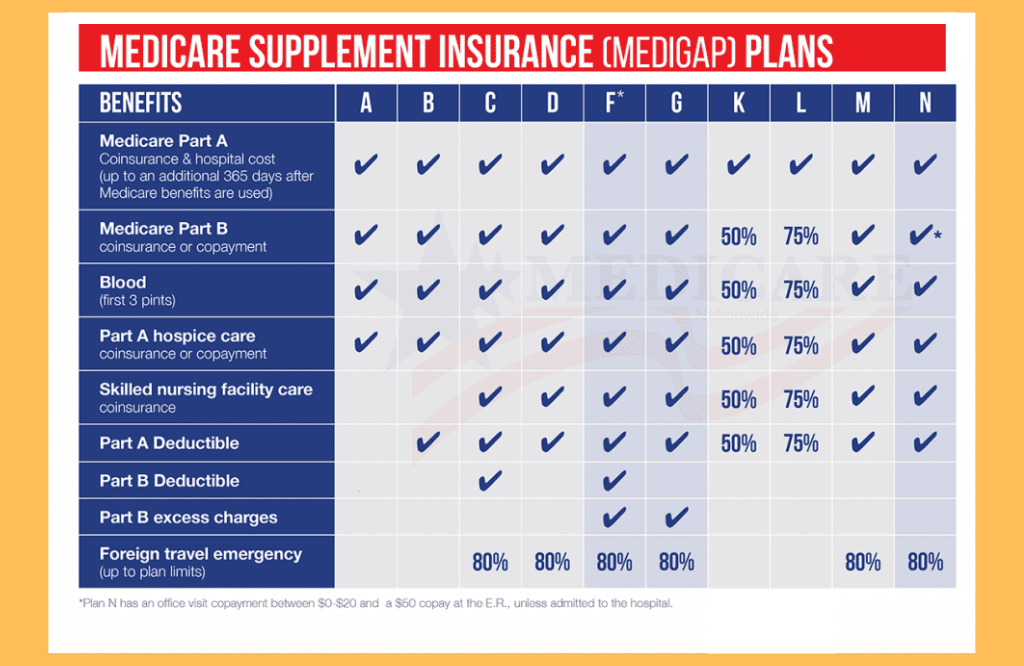

Medicare Supplement Insurance Plans, also known as Medigap plans, are policies sold by private insurance companies to help cover the gaps in costs that original Medicare does not pay for. These plans can help beneficiaries pay for expenses such as copayments, coinsurance, and deductibles.

Humana is a well-known and reputable insurance company with years of experience in offering Medicare Supplement Insurance Plans. They provide a variety of options to choose from, each with its own set of benefits and coverage levels.

Choosing a Medicare Supplement Insurance Plan from Humana can provide peace of mind and financial protection by filling in the coverage gaps left by original Medicare. These plans offer flexibility and predictability in healthcare costs, allowing beneficiaries to budget for medical expenses more effectively.

Coverage Options Offered by Humana Medicare Supplement Insurance Plans

- Plan A: Basic benefits covering essential costs such as hospital coinsurance and blood transfusions.

- Plan B: Includes all the benefits of Plan A with additional coverage for skilled nursing facility coinsurance.

- Plan F: The most comprehensive plan, covering all Medicare Part A and B deductibles, copayments, and excess charges.

Additional Benefits of Humana’s Medicare Supplement Insurance Plans, Humana medicare supplement insurance plans

In addition to the core benefits, Humana’s plans may offer perks such as gym memberships, vision and dental discounts, and access to telehealth services. These extra benefits can enhance the overall value of the plan and provide added convenience for beneficiaries.

Enrollment Process for Humana Medicare Supplement Insurance Plans

Enrolling in a Humana Medicare Supplement Insurance Plan involves completing an application form and providing information about your Medicare coverage. Eligibility criteria include being enrolled in Medicare Part A and B and living in the plan’s service area.

Applicants should be aware of specific enrollment periods, such as the Initial Enrollment Period, Open Enrollment Period, and Special Enrollment Periods, to sign up for a plan without penalties.

Network Coverage and Provider Options with Humana Medicare Supplement Insurance Plans

Humana’s Medicare Supplement plans typically offer nationwide coverage, allowing members to access healthcare services from any provider that accepts Medicare. Members can choose their doctors and specialists without the need for referrals, providing flexibility in managing their healthcare needs.

Final Thoughts

In conclusion, Humana Medicare Supplement Insurance Plans stand out for their comprehensive coverage options and reputable service, making them a reliable choice for individuals seeking quality healthcare coverage. Explore the possibilities and secure your peace of mind with Humana today.

FAQs: Humana Medicare Supplement Insurance Plans

What makes Humana’s Medicare Supplement Insurance Plans different from original Medicare?

Humana’s plans offer additional coverage beyond what original Medicare provides, including options for copayments, deductibles, and coinsurance.

Are there any limitations to the network coverage with Humana’s plans?

Humana’s network coverage varies by plan, so it’s essential to check which healthcare providers are included in the specific plan you choose.

Can individuals switch between different Humana Medicare Supplement Insurance Plans?

Yes, individuals can switch plans during specific enrollment periods, ensuring flexibility to adjust coverage based on changing healthcare needs.