Errors and omissions insurance for bookkeepers is a crucial aspect of risk management in the bookkeeping industry. From understanding coverage details to navigating the claims process, bookkeepers rely on this insurance to protect their financial well-being. Let’s delve into the intricacies of this vital coverage.

What is Errors and Omissions Insurance?

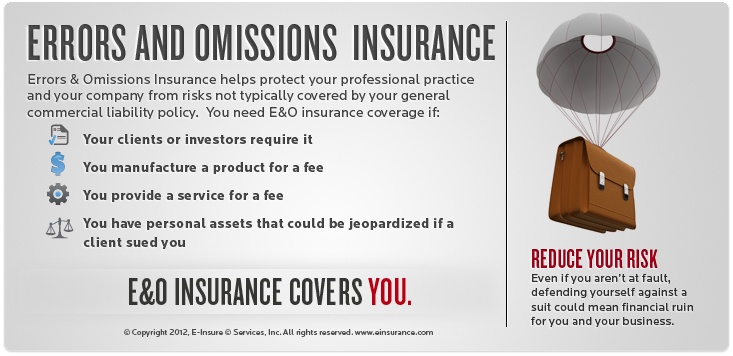

Errors and Omissions Insurance (E&O) is a type of professional liability insurance that provides coverage for financial losses resulting from negligence, errors, or omissions in the services provided. For bookkeepers, E&O insurance is crucial as it protects them from potential legal claims and lawsuits that may arise due to mistakes or oversights in their work. Without this coverage, bookkeepers could be personally liable for any damages incurred by their clients.

Examples of Situations Requiring E&O Insurance for Bookkeepers, Errors and omissions insurance for bookkeepers

– A bookkeeper miscalculates a client’s tax returns, resulting in penalties and fines.

– Failure to report income accurately, leading to financial losses for the client.

– Providing incorrect financial advice that causes a client to make poor investment decisions.

The Importance of E&O Insurance Coverage in the Bookkeeping Industry

Having Errors and Omissions Insurance coverage is essential for bookkeepers to protect their business and reputation. It provides financial security and peace of mind knowing that they are protected in case of unforeseen circumstances. E&O insurance also demonstrates professionalism and a commitment to quality service to clients.

Coverage Details

Errors and Omissions Insurance typically covers errors such as:

– Mismanagement of financial records

– Failure to meet deadlines

– Providing incorrect financial advice

Limitations and exclusions of E&O insurance policies may include:

– Intentional misconduct

– Fraudulent activities

– Claims arising from services not covered under the policy

Examples where E&O insurance coverage can be beneficial for bookkeepers:

– Defending against a lawsuit filed by a dissatisfied client

– Reimbursing clients for financial losses caused by errors in bookkeeping services

Cost and Factors

Factors that influence the cost of Errors and Omissions Insurance for bookkeepers include:

– Business size and revenue

– Coverage limits and deductibles

– Claims history and risk assessment

Bookkeepers can compare costs from different providers and choose the right coverage by:

– Evaluating the specific needs of their business

– Seeking quotes from multiple insurance companies

– Considering the level of protection required based on the services offered

Tips for reducing insurance costs while maintaining adequate coverage:

– Implementing risk management practices

– Investing in training and education

– Reviewing and updating insurance policies regularly

Claims Process

The steps involved in filing a claim under Errors and Omissions Insurance for bookkeepers include:

– Notifying the insurance provider of a potential claim

– Submitting relevant documentation and evidence

– Cooperating with the claims investigation process

Bookkeepers need to prepare when filing a claim by:

– Keeping detailed records of client interactions

– Documenting the services provided

– Providing any correspondence related to the claim

Common challenges or delays bookkeepers may face during the claims process include:

– Disputes over coverage eligibility

– Delays in claims processing

– Negotiations with the insurance provider

Importance of E&O Insurance

Errors and Omissions Insurance plays a crucial role in protecting bookkeepers from financial risks associated with professional services. It enhances credibility and professionalism by demonstrating a commitment to quality and accountability. Real-life examples and case studies show how E&O insurance has been instrumental in safeguarding bookkeepers’ businesses and clients’ interests.

Final Wrap-Up

In conclusion, errors and omissions insurance serves as a shield for bookkeepers, safeguarding them from potential financial pitfalls. By investing in this coverage, bookkeepers can enhance their credibility and ensure professional standards in their practice.

Question Bank: Errors And Omissions Insurance For Bookkeepers

What specific errors and omissions are typically covered by insurance for bookkeepers?

Errors such as negligence, misrepresentation, or incorrect advice are usually covered. Omissions like failing to provide a service are also included.

How can bookkeepers reduce their insurance costs while maintaining adequate coverage?

Bookkeepers can consider bundling their insurance policies, implementing risk management practices, or choosing a higher deductible to lower premiums.