Starting with the quest for the best insurance rates in NC, this introduction aims to grab the attention of readers with valuable insights and information.

Exploring the various factors, types of insurance, strategies, and regulations in North Carolina unveils a comprehensive guide to securing the most cost-effective coverage.

Factors Influencing Insurance Rates in North Carolina: Best Insurance Rates In Nc

Insurance rates in North Carolina are influenced by several key factors that play a significant role in determining the cost of insurance policies in the state. Understanding these factors can help individuals make informed decisions when shopping for insurance.

Key Factors Affecting Insurance Rates, Best insurance rates in nc

- Driving Record: A clean driving record with no accidents or traffic violations usually results in lower auto insurance rates.

- Location: The area where you live can impact insurance rates due to factors such as crime rates and weather-related risks.

- Credit Score: Insurance companies often use credit scores to assess the risk of insuring an individual, with better scores leading to lower rates.

- Type of Coverage: The type and amount of coverage you choose will directly affect your insurance premiums.

- Age and Gender: Younger drivers and males typically pay higher insurance rates due to statistical data on accident frequency.

Types of Insurance Available in North Carolina

North Carolina offers a variety of insurance options to its residents, catering to different needs and preferences. It’s essential to understand the types of insurance available to make informed decisions when selecting coverage.

Different Types of Insurance in NC

- Auto Insurance: Companies like State Farm, Geico, and Progressive offer auto insurance coverage in North Carolina.

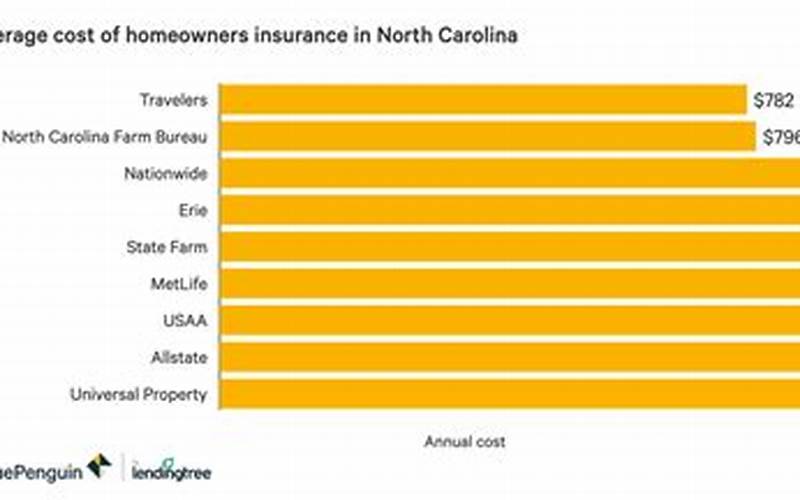

- Home Insurance: Allstate, Nationwide, and Liberty Mutual are some of the providers offering home insurance policies in the state.

- Health Insurance: Blue Cross Blue Shield, Aetna, and Cigna provide health insurance options to residents of North Carolina.

Strategies to Find the Best Insurance Rates in NC

Finding the best insurance rates in North Carolina requires some research and comparison shopping. By following these strategies, individuals can save money on insurance premiums while getting adequate coverage.

Tips for Finding the Best Rates

- Compare Multiple Quotes: Obtain quotes from different insurance providers to compare rates and coverage options.

- Consider Bundle Discounts: Bundling multiple insurance policies with the same provider can often lead to discounted rates.

- Improve Your Credit Score: Maintaining a good credit score can help lower insurance rates in North Carolina.

Regulations Affecting Insurance Rates in North Carolina

The state of North Carolina has regulations in place to protect consumers and ensure fair pricing in the insurance market. Understanding these regulations can provide insight into how insurance rates are determined and maintained in the state.

State Regulations Impacting Insurance Rates

- Rate Approval: Insurance companies must seek approval from the state before implementing rate changes, ensuring transparency and fairness.

- Consumer Protections: Regulations protect consumers from unfair practices and ensure timely claims processing by insurance companies.

- Market Competition: Regulations aim to foster healthy competition among insurance providers, leading to better options for consumers in North Carolina.

Conclusive Thoughts

Wrapping up our discussion on best insurance rates in NC, it’s evident that with the right approach and understanding, finding affordable coverage in the state is within reach.

Query Resolution

What factors can influence insurance rates in North Carolina?

The key factors include age, driving record, location, type of coverage, and credit score.

How can I find the best insurance rates in NC?

To find the best rates, compare quotes from different providers, consider bundling policies, and maintain a good credit score.

What are the common types of insurance available in North Carolina?

Common types include auto, home, health, life, and business insurance, among others.

How do regulations in North Carolina impact insurance rates?

Regulations protect consumers, ensure fair pricing, and influence market competitiveness among insurance providers.